-

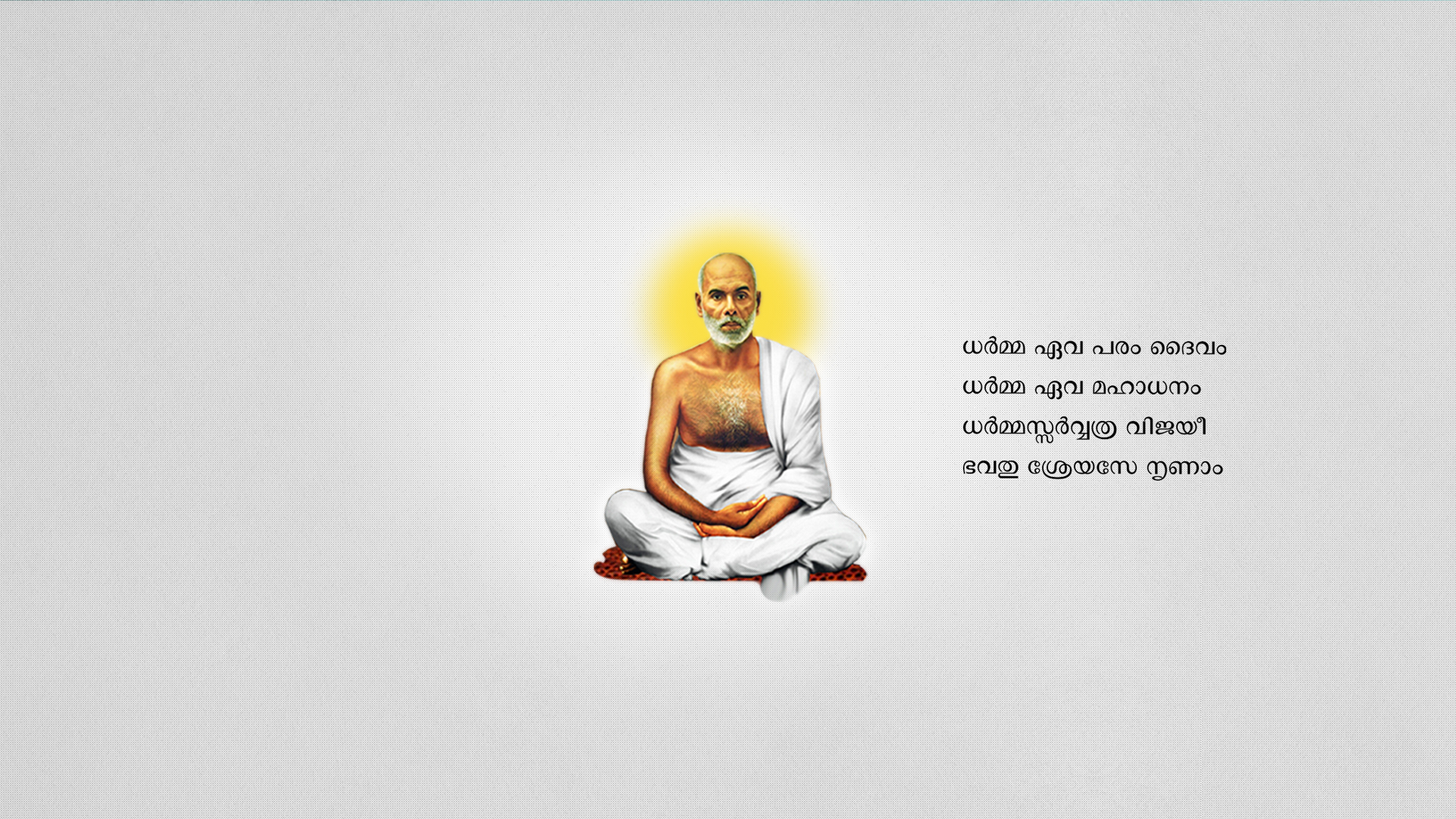

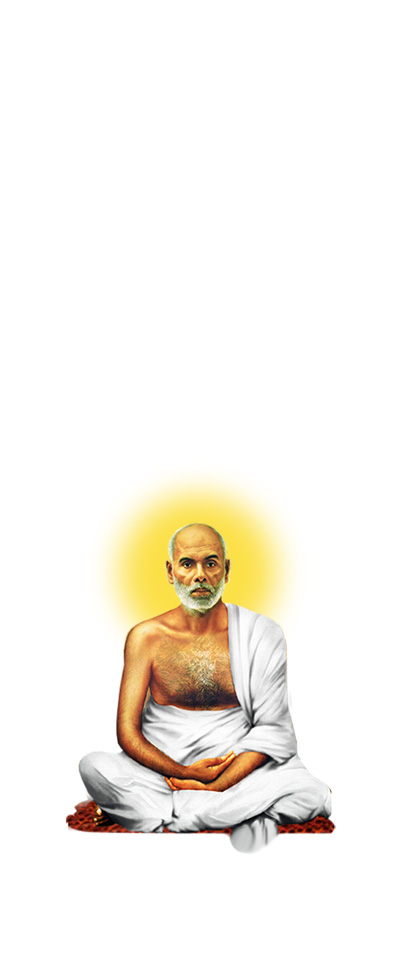

Our Story...

1998 - Founded Sree Narayana Gurudharmam Trust

Gurudharmam Trust is an organisation formed by a group of visionaries and true followers of Sree Narayana Guru, to carry forward the teachings and philosophies of Guru,in the year 1998. With more than 20 years of experience, the Trust's functionality has always remained true to the ideology of the Guru.

Know More...

-

Our Story...

2010 - Mala Gurudharmam chits

Our Chit Funds are indigenous financial institutions in India that combines credit and savings in a single scheme. In a chit fund scheme, a group of individuals come together for a predetermined time period and contribute to a common pool at regular intervals.The non prized subscriber who is a saving member up to the

Know More...

-

Our Story...

2012 - Nidhi company

Through this venture, Gurudharmam introduced modern financial tools that will lead the society to entire development and fulfill the ambitions of people.This company is the result of changing trends in the financial sector in Kerala, and is a part of the financial growth of Gurudharmam community.

Know More...

-

Our Story...

2014 - Guru Dharmam mission hospital

A comprehensive state of the art healthcare solution for Mala.In addition to providing excellent medical care,as part of merging educational purposes with healthcare. SNDT is proud to present it’s latest venture in the healthcare sector, Gurudharmam Mission Hospital Ltd, Mala.

Know More...

-

Our Story...

2019- Guru Dharmam Trading company

Aims to bring financial prosperity to its investors and customers alike by establishing showroom outlets of Home appliances,Grocery and jewellery.

Know More...

-

Our Story...

2019-Formed Gurudharmam finance

and amalgamated with Gurudharmam Fincorp to take financial services to the next level for the growth of the Narayaneeyam community.

Know More...

Contact Us

Address

Sree Narayana Gurudharmam Trust Building, P.O.Road, MalaThrissur. Pincode- 680732